Your Roadmap to the Global Plastic Credit Market

An Official Plastic Credit Market is Born

The plastic problem is not new, yet the slew of corporate pledges driven by legislation and stakeholder pressures are. With corporates avidly searching for solutions, a plastic credit market was born. Like the carbon credit market it emulates, the plastic credit market is a mechanism that drives investments into:

- recycled plastic procurement,

- plastic collection projects, and

- plastic recycling projects

Plastic Credit sales generate capital for such projects. For every credit bought, one tonne of plastic is collected or recycled in addition to what would have happened without the transaction.

How is the market regulated?

Various unofficial plastic credit programs have existed in a fragmented landscape since 2017. Until recently, the lack of established best practices and standards prevented companies from assessing a credit program’s impact claims. The February 2021 launch of the Plastic Waste Reduction Standard (the Plastic Standard), and its complimentary Guidelines for Corporate Plastic Stewardship (Guidelines for Corporates), marked a global turning point. The Guidelines for Corporates offer a “how to” based on the Plastic Standard, which establishes “…rules and methodologies to quantify and account for the collection and/or recycling of waste and incorporates social and environmental safeguards” for a project to be certified, including independent auditing(1). Only vetted projects that meet the Plastic Standard’s strict requirements are added to the official Verra Registry. Corporates should be aware that while some unofficial plastic credit programs are transitioning to align with the new Plastic Standard, others may not and pose potential risks.

Plastic credit programs that do not shift towards adopting Plastic Standard best practices come with higher risk. For example, a program’s projects, which are typically in developing countries, may not meet their plastic collection and recycling targets thereby undermining impact. Projects may also use child labor, withhold workers’ wages, and have unsafe working conditions. When partnering with programs that do not align with the Plastic Standard, a company must accept potential regulatory and reputational consequences that such a decision poses(2). Nevertheless, there are several best practices to consider when selecting a plastic credit program partner.

Plastic Credit Fundamentals

In addition to reducing a company’s plastic dependency, a company can tap into the new plastic market to neutralize unavoidable plastic in their supply chain (see section below, “Using Plastic Credits Credibly”). Buying credits can remove two kinds of plastic: a) Current/future plastic a company places on the market and b) legacy plastic a company historically generated(3). A business must therefore first calculate how much plastic they are putting, or have put, onto the market. This is known as a business’ plastic footprint. Once a footprint is established, the company purchases a volume of credits equivalent to either a proportion or 100% of their footprint to counteract their plastic use. Some businesses commit to covering 100% of their plastic footprint, others transition to 100% over time. (Plastic Credits are one tool in the toolbox to lower a plastic footprint. Several other tools should first be considered. See Figure 3 below.) For Coca-Cola to negate a 10,000 tonne plastic footprint solely utilizing credits, for example, they would purchase, at minimum, 10,000 tonnes of Waste Collection Credits as the Plastic Standard equates one credit to one tonne. (The exact number of credits bought would depend on Coca-Cola’s specific plastic claim. See section “Official Plastic Leadership commitments and Claims” for details.) But how exactly does the credit purchase work in practice?

A Credit’s Lifecycle

There are various players in the plastic credit market to ensure the Plastic Standard is upheld (see Figure 1 below). A company will typically first consult a project Seller/Broker, the actor that facilitates the Plastic Credit transaction, for guidance on which project(s) are most relevant to their business to purchase credits from. Next, the company visits the Verra Registry, a portfolio of third-party verified plastic collection and recycling projects, to purchase credits from a project(s). The Plastic Standard requires projects on this Registry to go through a rigorous validation process before being added, as well as to maintain a project’s Registry presence, while simultaneously offering public comment periods. The Registry transparently lists: the entity that established and operates the project (a.k.a the Project Proponent), the number of credits available, the quantity of credits already purchased, and other key project documentation. To ensure such information is up-to-date, Project Proponents are required to monitor and report on their projects in accordance with the Standard on an ongoing basis.

Project Identification

Company consults a Broker/Seller to identify an appropriate project

Credit Purchase

Company purchases Plastic Credits from vetted project on Verra’s Registry

Credit Issuance & Claim

Verra’s Registry issues the company Plastic Credits linked with unique serial numbers. Company publicly claims plastic leakage collection and/or recycling.

Credits Catalyze Impact

Plastic Credit funds are invested into collection and/or recycling projects to reduce plastic leakage into the environment.

Figure 1) Credit Lifecycle(4)

Once a company purchases credits from a project, the Registry issues the company Plastic Credits which are linked to unique serial numbers. Proof that the company has bought credits to collect and/or recycle a quantity of plastic, in alignment with the Plastic Standard, is publicly available on the Registry. The Registry therefore avoids situations where two companies are sold the same Plastic Credit or a company greenwashes by exaggerating the amount of credit purchased. At this point, a company can claim the impact of their credits publicly(5).

Plastic Credit funds are then invested into collection and/or recycling projects. To ensure a plastic project is effective, an independent Verification Body audits whether the project actually accomplished what the Project Proponent claims the project collects and/or recycles.

In practice, one player can wear multiple “hats”. We at Plastic Collective, for example, function holistically as a Broker and a Project Proponent. As a Project Proponent, we do NOT own the collection or recycling projects that we support with training, tailored technologies, and supply chain logistics. Our community project partners hold full ownership over their recovery and recycling operations. Other organizations function solely as Brokers, which distances them from the communities these projects serve. Consequently, such organizations have a more limited understanding of how to ensure project sustainability in a manner that is socially, environmentally, and financially successful.

Plastic Credits Create Shared Value

Plastic Credits offer a pathway to social, environmental, and business value.

Business Value: The plastic credit market serves to signal which projects are investable, as qualified by the Plastic Standard’s methodology. This allows corporates to invest in impactful, quality-assured projects. The result? Companies benefit by being able to credibly claim responsibility for managing a portion of the plastic they put, or have put, into the environment. Moreover, companies benefit as the reputational risk of selecting a project, with potential human rights or environmental issues, falls on third parties like the Plastic Standard, the project Marketer, etc. – not the brand. At the other end of the transaction, collectors and recyclers secure a new funding source. This is prime timing given the trend of plummeting commodity prices that prevent recycled material from overtaking virgin plastic commodity prices. Beyond the immediate environmental and health values that the removal of plastic from our oceans and communities create, credit funded projects can trigger multiple co-benefits.

Environmental and Social Value: Depending on the project, credits generate various benefits for communities and ecosystems. For example, in Indonesia, Plastic Collective is supporting the rural community of Les Village in partnership with TK Maxx and Earthwatch Australia. Utilizing Plastic Collective’s micro-technology, the Mobile Shruder transforms plastic waste collected from households and businesses and recycles it into recycled plastic material, which Les Village sells.

Source: Plastic Collective, Les Village project in Indonesia

This project has created 6 new jobs in the community over two years. While this example may solely sound like business benefits, it in fact catalyzes social and environmental outputs including:

-

A more environmentally educated community mitigates future plastic leakage into the environment

As a part of making this project sustainable at all levels, Plastic Collective engaged the community through environmental education and capacity building programs. Such engagement taught the community that their plastic waste has value, which mitigates future plastic leakage into the environment. Education also offers a two-way learning channel. As the community is engaged through education, the community provides feedback to Plastic Collective that is incorporated into the recycling project. Such feedback promotes the continuous improvement of the project to ensure it meets local needs and is more resilient on the long-term.

-

A healthier community

Prior to the recycling project, families had no choice but to burn, dump, or bury plastic to dispose of the waste. These disposal practices, typical strategies in developing countries, can create health issues for those inhaling the smoke as well as for the community and biodiversity that relies on the rivers, oceans, and soil that mismanaged plastic waste pollutes.

-

New recycling jobs catalyze a ripple effect of opportunities including pride and environmental stewardship

In a small community like Les Village, such pride from a recycling job provides a consistent source of income that then triggers increased access to health, education, medical attention, etc. A job for one person, therefore, offers so much more than just income – a job offers an entire family health and economic safety nets.

-

Lower greenhouse gas emissions

Plastic collection and recycling avoid greenhouse gas emissions from sources like ocean plastic degradation, incineration, and landfills.

Policy Value: Credits can also support the passage of Extended Producer Responsibility (EPR) legislation(6). When credits serve as start-up funds for a business to pilot a voluntary collection and/or recycling program, the pilot gives government “ammunition” to counter EPR legislation pushback as pilots offer proof-of-concept. The pilot simultaneously allows a business to obtain buy-in from senior leadership, including its board and investors, by demonstrating that a voluntary take-back and or recycling scheme is viable. Therefore, regardless of whether EPR legislation passes, voluntary corporate programs can potentially drive company-wide plastic stewardship adoption. When used in this manner, Plastic Credits can compliment, not substitute, EPR legislation.

Official Plastic Leadership Commitments and Claims

Setting plastic reduction targets, taking action, and communicating progress are essential to corporate leadership. Depending on several factors (see “Selecting Within & Beyond Value Chain Action, below), companies can choose from three official plastic stewardship claims and can apply these at the product, market, or company-wide level(7, 8, 9, 10):

Claim 1 - “Net Zero Plastic Leakage"

Claim Example: A cosmetics brand sells face moisturizer in plastic containers. During a one-year period, face moisturizer sales generate 10 tonnes of plastic waste that the company cannot guarantee is collected. For the brand to claim that the face moisturizer is Net Zero that year, it must either demonstrate collection of 10 tonnes of plastic waste or purchase an equivalent 10 tonnes of Waste Collection Credits.

Claim 2 - “Net 100% Recycled at End-of-Life"

…means that an equivalent to the total weight of plastic put into a market is recycled. A company can achieve Net 100% Recycled at End-of-Life through a combination of collection and recycling activities both within and beyond its value chain…to achieve this claim, a company should first attain Net Zero Plastic Leakage. Next, it should retire [ ] [Waste Recycling Credits] equivalent to the number of [ ] [Waste Collection Credits] used to achieve Net Zero Plastic Leakage to ensure that amount of plastic is recycled. Finally, it should compensate for any plastic collected but not recycled (i.e. that which is converted to energy or ends up in a landfill) by retiring an equivalent amount of [ ] [Waste Recycling Credits].”

Claim Example: Continuing on from our example above, the same cosmetic brand selling a moisturizer product line may instead prefer to claim Net 100% Recycled at End-of-Life. In this case they may purchase 10 tonnes of each credit, Waste Collection Credits and Waste Recycling Credits, for a total of 20 tonnes of Plastic Credits. Alternatively, they can demonstrate collection and recycling for the same 20 tonnes total.

Claim 3 - “Net Circular Plastic"

…means that a product is composed of 100 percent recycled content and that the used plastic — or an equivalent amount of the same material type, compensated for through the retirement of plastic credits — is recycled. Net 100% Recycled at End-of-Life represents the outflow side of Net Circular Plastic.”

Claim Example: To reach the gold standard of plastic claims, the cosmetic brand will select a Net Circular Plastic claim for its moisturizer line. This requires the brand to procure 100% recycled plastic material to use for their moisturizer product, or purchase the equivalent in Recycled Material Credits. If solely using a credits strategy for the 10 tonnes of plastic in the moisturizer container, the brand would purchase 10 tonnes of Recycled Materials Credits, 10 tonnes of Waste Collection Credits, and 10 tonnes of Waste Recycling Credits. However, due to the limited availability of recycled material inputs and Recycled Material Credits on the market, it may be challenging for a brand to achieve this claim at this time.

Some companies may choose to publicly phrase their commitments by using other claims beyond these above three examples. In such cases, the Plastic Standard encourages companies to follow several best practices.

How to Make Reputable Plastic Commitments & Claims

To align with best practice, commitments and claims must be explicit, clear, and independently verified(11). These three pillars mitigate potential reputational risks associated with greenwashing and bluewashing while promoting transparency and credibility. Regardless of whether a company adopts one of the three Plastic Standard claims or distinct claim, like Plastic Neutral, there are five elements to consider to reputably make such commitments:

Table 1: Elements of a Reputable Plastic Commitment & Claim(12)

ELEMENT

REQUIRED INFORMATION

Accounting methods

Approach used to calculate the amount of plastic in a footprint or that is leaked.

Approaches used in quantification of plastic credits used for compensating leakage or lack of recycling

Scope of compensation

Whether compensation includes plastic inputs of a product, waste generated, assumed leakage or a combination of these.

Double counting

Plastic credits

Whether these claims refer to plastic that would have been removed from the environment in a business-as-usual scenario or with governmental support

Plastic credit serial numbers and registry references (to ensure that the credit has only been attributed to one buyer)

Information on the specific material type and geography of the plastic pollution for which the credits are intended to compensate

Level of circularity of claim

Using Plastic Credits Credibly

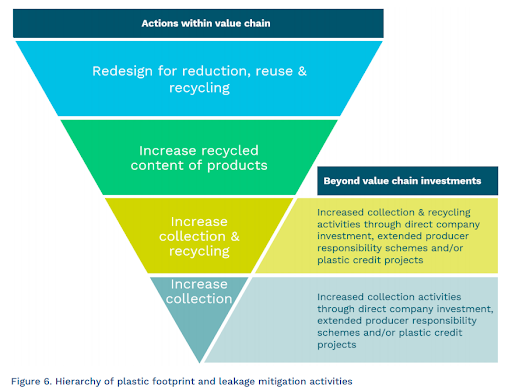

Credits are designed to compliment a company’s overarching plastic reduction strategy and not as a silver bullet. A holistic strategy prioritizes activities in line with the waste hierarchy: reduce, reuse, and only then recycle (see Figure 2 below). As with many sustainability solutions, the plastic credit market’s ability to drive a positive impact will depend on how credits are used. In this age of radical transparency, companies and plastic credit programs will be held accountable by consumers, nonprofits, and investors if a company uses credits as a license to pollution. A credible plastic stewardship strategy will include several components:

- An honest acknowledgment of the plastic problem and the company’s specific contribution to this issue

- Measurable targets based on the Guidelines for Corporates

- A transparent, public facing plan outlining clear, time-bound, and measurable targets

- Activities should address the four areas in Figure 2 below in descending priority, from top to bottom

Figure 2: Hierarchy of Plastic Footprint & Leakage Mitigation Activities(13)

As companies establish activities to lower their plastic footprint, Plastic Credits can be used as a transitional tool. When used responsibly, a company will lower their dependency on Plastic Credits as collection and recycling activities crystalize within their value chain. That said, there are two exceptions.

- Legacy plastic is typically retroactively managed by investing in beyond value chain collection and recycling projects, particularly via Plastic Credits(14), and

- High-performing EPR programs do not divert 100% of plastic waste. Current strong programs have 70% to 80% recycling rates while lower performs hover at just 6%(15). Plastic Credits can bridge this EPR performance gap.

Selecting Within & Beyond Value Chain Actions

While the first two actions in the above hierarchy entail changes within a company’s value chain, increasing recycling and collection can also be done by investing in activities beyond the value chain. Deciding on a within/beyond value chain approach differs for each business. This end-of-life choice typically hinges on a company’s:

- level of ambition,

- capacity to execute,

- resource availability,

- operating environment policy context (i.e., EPR legislation, plastic tax, health and safety regulation targeting the medical and food industry, etc.),

- geography of operations and product sales,

- operating context with regards to differences in infrastructure, and

- stewardship responsibility timespan (counteracting current/future plastic versus retroactively taking responsibility for legacy plastic previously put on the market)

Many companies start with a beyond the value chain approach that leverages Plastic Credits. Credit funds are invested into a project that performs the collection and/or recycling on the business’ behalf. Such a solution is a particularly good fit for companies that:

- Have operations and/or consumers in Asia

Asia is a global plastic leakage hotspot, given poor waste management infrastructure. For that reason, many established community collection and recycling projects exist in the region and are in need of funding. This is exactly why our program at Plastic Collective began by supporting communities in Asia when we launched in 2016. - Need time to establish their own, within value chain, collection and recycling take-back scheme

- Seek to take responsibility for past decades of plastic pollution

For decades, Western countries have shipped (and continue to) their waste to developing countries with poor waste management infrastructure. While some countries like China, via their 2018 National Sword Policy, closed their ports, others like Vietnam and Indonesia are granting wider access. Consequently, a handful of South East Asian countries have become plastic leakage hotspots polluting our oceans and communities. To retroactively take responsibility, companies are using Plastic Credits to fund Asia-based projects beyond their value chain. True leaders are also procuring recycled plastic material from their projects to include in their European and North American products – the demand origin of recycled plastic.

The Ellen MacArthur Foundation & Plastic Standard Dynamic

The Ellen MacArthur Foundation’s (EMF) New Plastics Economy Global Commitment (Global Commitment) strongly complements the Plastic Standard. While a circular economy is the common goal, the two approaches differ. Comparing the types of commitments, plastic accounting baseline methodologies, reporting metrics, and mitigation activities reveals a complementary opportunity.

The Global Commitment’s foremost focus is on upstream strategies within a company’s supply chain, particularly packaging. This emphasis is apparent in the overarching commitments companies sign onto achieving by 2025 that include(16):

- Take action to eliminate problematic or unnecessary plastic packaging

- Take action to move from single-use towards reuse models where relevant

- 100% of plastic packaging to be reusable, recyclable, or compostable

- Set an ambitious recycled content target across all plastic packaging used

A company’s progress in these above areas is gauged by metrics compared against a baseline that tracks the amount of plastic used by the business. Examples of metrics include: percent of reusable plastic packaging and percent of post consumer recycled content sourced(17). Since commitments, metrics, and the baseline center on plastic use prevention, a company will inevitably gravitate towards upstream plastic mitigation activities within their value chain that they can directly control. Upstream activities may include, for example, procuring bio-based and recycled plastic content to substitute for virgin plastic material and redesigning to reduce the amount plastic in a product line. While EMF’s Global Commitment offers companies a great entry point to plastic stewardship, several downstream opportunities also exist to transition to a circular economy within and beyond a company’s value chain.

The Plastic Standard and Guidelines for Corporates can support companies to responsibly manage unavoidable plastic downstream. Companies that have fully maximized the reduction of their plastic footprints have likely found themselves in one of three scenarios:

- Health and safety regulations prevent the company from lowering their plastic use. This is typical in the medical and food industry.

- Practically speaking, the company’s plastic stewardship champion(s) is unable, at that point in time, to obtain the necessary buy-in from senior leadership to lower the business’s plastic use.

- The company is a global leader and has, given current technologies, exhausted plastic reduction efforts. Instead of being on standby passively, the company reorients from preventative to retroactive plastic action. This allows a company to address their legacy plastic pollution from decades past. (Note that this path is not reserved for global leaders and aspiring leaders are encouraged to explore this regenerative approach.)

The Plastic Standard, and its complementary Guidelines for Corporates, offers such companies several levers for impact.

Companies can address downstream plastic waste within as well as beyond their value chain. A company can adopt one of several commitments: a) Net zero plastic leakage, b) Net 100% recycled at end-of-life, or c) Net circular plastic. (See “Official Plastic Leadership Commitments and Claims” section, above.) A company’s progress on these commitments depends on a plastic baseline and metrics that go beyond a company’s plastic use, as is the case with EMF, and includes plastic leakage as well as the direct and indirect impact of plastic pollutants on human health and the environment(18). One metric, for example, is the percent recycled and non-recycled content of plastic waste generated by downstream activities(19). Guided by the Standard’s best practices, companies can invest in plastic collection and recycling activities to responsibly manage their waste. Some companies choose to develop this collection and recycling infrastructure within their value chain; this is known as product stewardship. Others, however, will invest in the same infrastructure beyond their value chain. Such beyond value chain investments can take the form of plastic credits and/or product stewardship that is managed externally through a Producer Responsibility Organization(20).

The EMF’s Global Commitment and the Plastic Standard offer companies a holistic set of strategies to set and meet ambitious plastic reduction commitments. The Guidelines for Corporates strongly encourages businesses to utilize EMF’s annual Global Commitment Progress Report to simultaneously share progress on their Plastic Standard metrics. Only by addressing upstream and downstream plastic can we transition towards a circular economy while mitigating the harms from unavoidable plastic, both future and legacy.

Learn More!

Have other questions? Check out the FAQ section on Verra’s Plastic Standard webpage. Prefer to chat with a real person? We are happy to support you on this learning journey! Feel free to reach out to me directly (tess@plasticcollective.co) at Plastic Collective, France.

1 Retrieved from www.3rinitiative.org/plastic-standard on 14 February 2021

2 Human rights due diligence laws are one potential risk. Several such laws exist, including in Germany. The European Commission is scheduled to vote in March 2021 on mandatory due diligence legislation for companies procuring materials from suppliers that violate human rights

3 Legacy Plastic: For decades, Western countries have (and continue to) shipped their waste to developing countries with poor waste management infrastructure. While some countries like China, via their 2018 National Sword Policy, have closed their ports, others like Vietnam and Indonesia have granted wider access. Consequently, a handful of South East Asian countries have become waste hotspots that leak plastic into oceans. Given this context, companies frequently source recycled plastic from the East to include in European and North American products, which is the demand origin for recycled plastic.

4 Plastic Collective, 2021

5 For more guidance, see below sections titled, “Official Plastic Leadership Commitments and Claims” and “How to Make Reputable Plastic Commitments and Claims”

6 Product Stewardship Institute, a US-based nonprofit, defines these terms as follows. “Product Stewardship is the act of minimizing the health, safety, environmental, and social impacts of a product and its packaging throughout all lifecycle stages, while also maximizing economic benefits…Stewardship can be either voluntary or required by law…EPR is a mandatory type of product stewardship that includes, at a minimum, the requirement that the manufacturer’s responsibility for its product extends to post-consumer management of that product and its packaging.”

7 Plastic claims quote the official 3R Initiative wording retrieved on 15 February 2021 from www.3rinitiative.org/guidelines-for-corporates (emphasis added)

8 Plastic claims quote the official 3R Initiative wording retrieved on 15 February 2021 from www.3rinitiative.org/guidelines-for-corporates (emphasis added)

9 Plastic claim quotes the official 3R Initiative wording retrieved on 15 February 2021 from www.3rinitiative.org/guidelines-for-corporates (emphasis added)

10 The latter Recycled Material Credits are currently under development by the Recycled Material Standard.

11 See section 4.4 in the Guidelines for Corporate Plastic Stewardship

12 Table 1 cites the Guidelines for Corporate Plastic Stewardship, published February 2021. Retrieved on 15 February 2021 from www.3rinitiative.org/guidelines-for-corporates

13 Image obtained from the Guidelines for Corporate Plastic Stewardship, published February 2021 and retrieved on 15 February 2021 from www.3rinitiative.org/guidelines-for-corporates.

14 Note: A company can directly establish a collection and recycling project for legacy plastic, but this is not common in practice.

15 Product Stewardship Institute, 2021. Retrieved from www.productstewardship.us/page/Packaging

16 Global Commitment Definitions 2020, retrieved from www.newplasticseconomy.org/assets/doc/Global-Commitment_Definitions_2020-1.pdf on 23 February 2021, emphasis added.

17 Organisation Reports: Global Commitment 2020 Progress Report, retrieved from www.ellenmacarthurfoundation.org/resources/apply/global-commitment-progress-report/organisation-reports on 23 February 2021.

18 Guidelines for Corporate Plastic Stewardship, published February 2021 and retrieved on 15 February 2021 from www.3rinitiative.org/guidelines-for-corporates

19 Guidelines for Corporate Plastic Stewardship, published February 2021 and retrieved on 15 February 2021 from www.3rinitiative.org/guidelines-for-corporates.

20 For information on the role of Producer Responsibility Organizations, refer to the “Who does what?” section here: www.canada.ca/en/environment-climate-change/services/managing-reducing-waste/overview-extended-producer-responsibility/introduction.html